Recovery Co-Pilot

Recover More Overdue Revenue - Without Adding Staff or Risk

Voice-led payment recovery for overdue invoices, accounts receivable, and missed payments — handled under your brand and compliance standards.

- Significantly improve recovery rates compared to manual follow-ups

- No subscriptions or hidden fees - pay only on results

- Compliance-aware, customer-friendly approach

Profit is strategy. Cashflow is survival

Recovery. Re-imagined

Cleveri Recovery Co-Pilot helps financial teams re-engage overdue customers early — before missed payments escalate further.

We manage consistent, well-timed conversations under your brand, guiding customers toward resolution with clarity and respect.

The result: faster recoveries, stronger customer relationships, and a recovery process your team can trust — without compliance headaches.

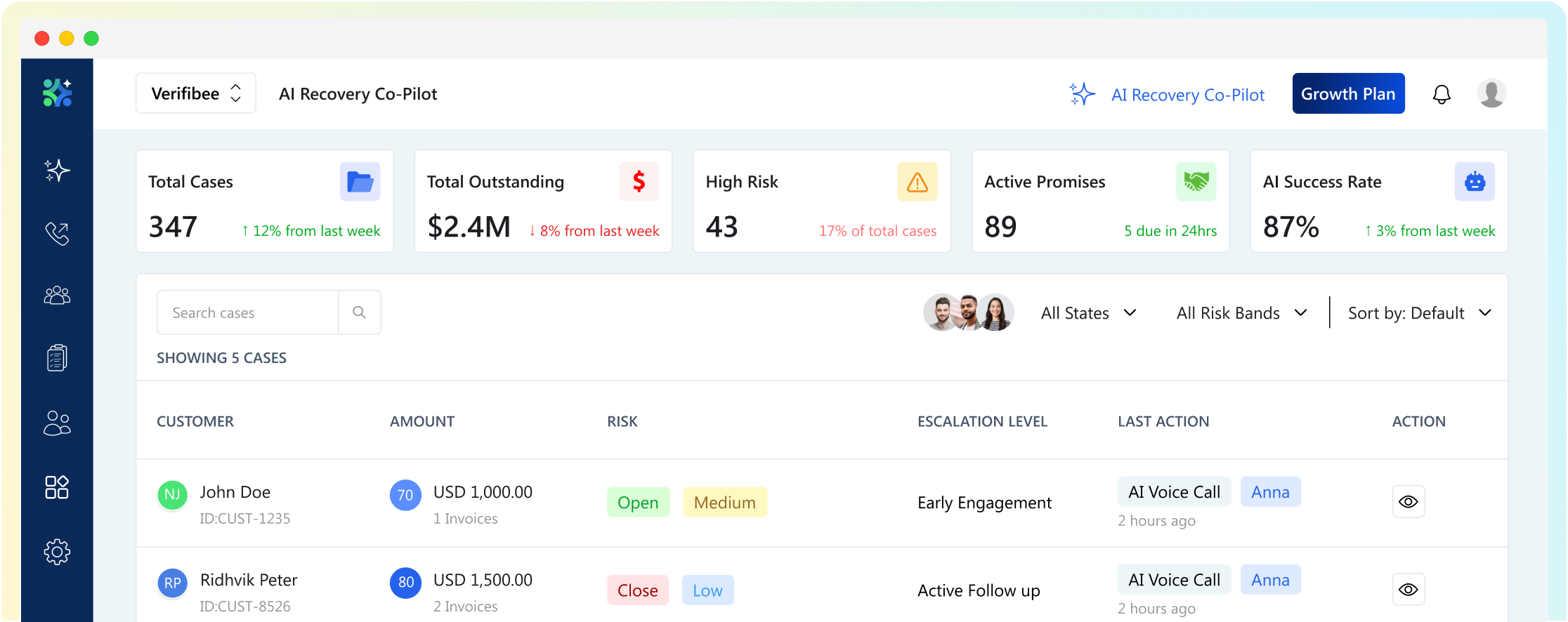

Meet Cleveri Recovery Co-Pilot

Smarter Recovery. Seamless Experience

Cleveri Recovery Co-Pilot handles overdue account conversations on your behalf — consistently, empathetically, and under your brand.

We manage the calls, follow-ups, and outcomes according to your rules, so your team focuses only on exceptions.

Simple setup. Seamless operation.

From Missed to Paid — In Days, Not Months.

Cleveri fits into your existing setup, handles recovery conversations under your brand, and delivers results — without disrupting your team or compliance framework.

01.

Connect Your System

Get started without heavy setup or IT effort.

Cleveri connects securely to your existing accounting or banking systems, so overdue accounts are identified and updated automatically.

-

Integrates with Xero, QuickBooks, Sage Intacct, and more

-

Connects to UK & EU banks via TrueLayer

-

Optional CSV upload for manual lists or smaller portfolios

02.

Set Your Rules

You stay in control — always.

You define how and when customers are contacted, what options are offered, and when cases should escalate.

-

Set brand tone, call timing, and contact frequency

-

Configure payment options and retry intervals

-

Apply your internal policies and regulatory requirements

03.

Conversations Begin

Polite, well-timed outreach — under your brand.

Customers are contacted at the right time, with conversations that feel natural and respectful — not scripted or aggressive.

(No robotic reminders. Just proper conversations.)

-

Natural voice conversations designed for financial situations

-

Adapts to customer responses and intent

-

Reaches customers consistently without manual effort

04.

Human Support, When It Matters

Sensitive cases handled by experienced specialists.

When a conversation needs empathy, negotiation, or judgement, recovery specialists step in seamlessly — fully informed and aligned to your standards.

-

Experienced recovery professionals handle escalations

-

Full context passed from earlier conversations

-

Respectful, compliant handling that protects relationships

05.

Clear Outcomes & Full Visibility

You see what’s working — and what’s paid.

Recovered payments go directly to you, with clear visibility into performance and outcomes.

-

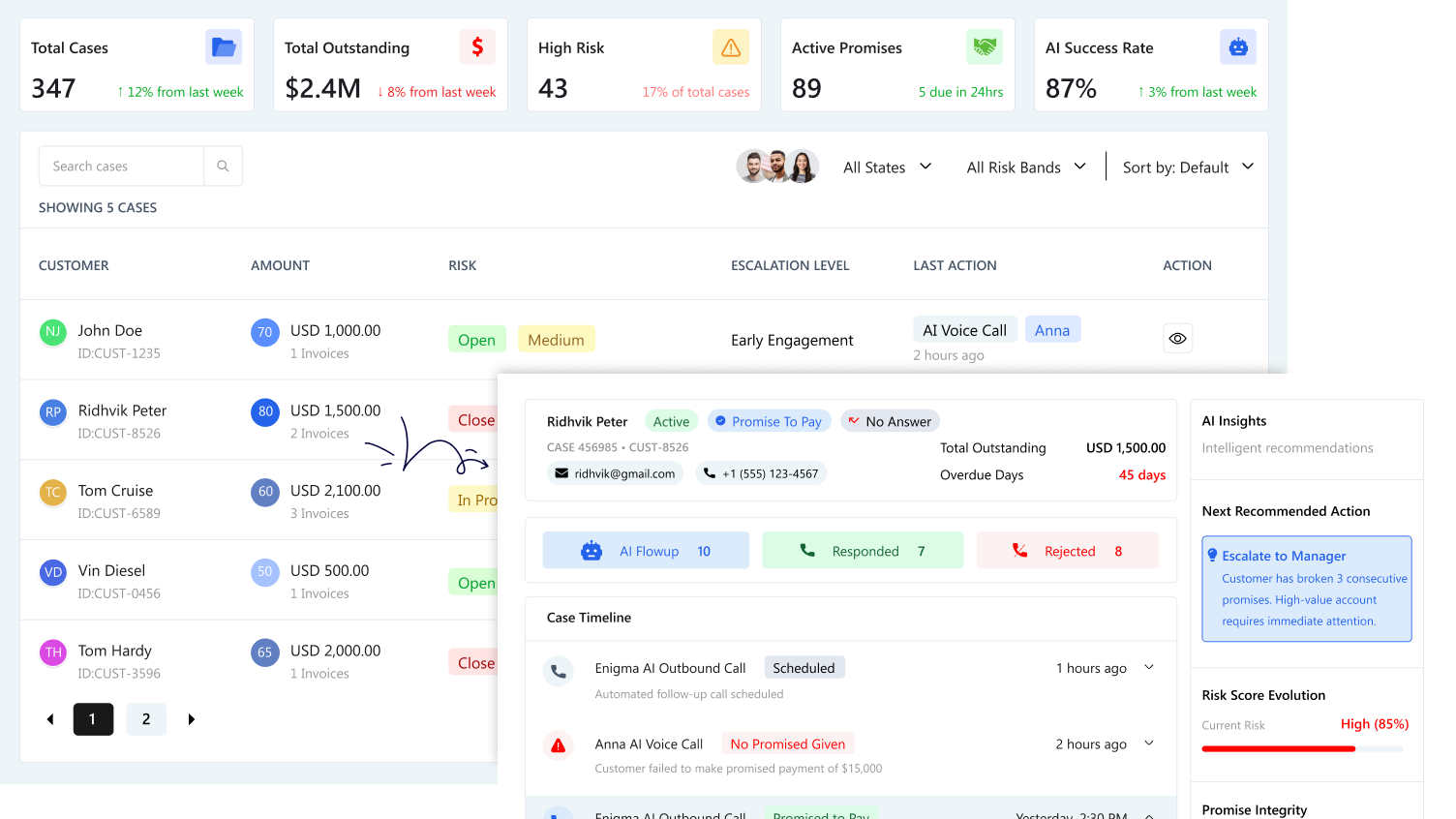

Real-time view of conversations, commitments, and payments

-

Automated reconciliation with your systems

-

Clear reporting for internal review and compliance

Predictable Costs. Proven Returns.

Only Pay for Real Recoveries

There are no subscriptions or hidden fees — just transparent, performance-based pricing aligned to results.

Start with a low-commitment setup, then scale into a longer-term partnership as recoveries improve and volume grows.

Starter Plan

Best for small portfolios or early adopters.

£299 minimum monthly commitment.

*6-10% Success Fee

Pay only on recovered amounts.

If the success fee exceeds £299, you pay the success fee only — never both.

- Connects with QuickBooks, Xero, Clio

- Secure connection to UK & EU banks

- Optional CSV upload for smaller portfolios

- Intelligent risk-based prioritisation

- Consistent outreach for unpaid invoices

- Automated reconciliation

Ideal for:

SMEs, Property Managers, Facilities Firms, and early adopters.

Growth Plan

Best for growing & mid-size portfolios.

£999 minimum monthly commitment.

*3-8% Success Fee

Lower fees with higher volumes, plus dedicated support for teams managing ongoing arrears.

- Everything in Starter, plus

- Multi-channel engagement (voice, SMS, email)

- Dedicated account manager

- Escalation to trained human recovery specialists**

- Standard performance and compliance reports

- Credit Monitoring

Ideal for:

Mid-size portfolios, Subscription Businesses, and Finanace Teams with regular arrears.

Partner Plan

Best for large portfolios and regulated financial institutions

£1,999 minimum monthly commitment.

*2-6% Success Fee

Designed for enterprise-scale recovery with deeper control, reporting, and custom workflows.

- Everything in Growth, plus

- Custom integrations (accounting, CRM, communication systems)

- Customised conversation tone and scripts

- Prioritised worklists for human teams

- SLA-backed reporting and reviews

Ideal for:

Financial institutions, high-volume portfolios, and compliance-heavy environments.

* Success Fee varies (3–8%) based on account age, portfolio characteristics, and recovery complexity. Fees apply only to amounts successfully collected.

** When escalation is required, trained recovery specialists handle cases under your brand and supervision, following agreed tone, policies, and compliance requirements.

All pricing excludes applicable taxes.

Built for Trust. Backed by Compliance

Your data privacy is

our top priority

Cleveri operates under the highest data security standards.

We are ISO 27001, SOC 2 certified, and GDPR compliant with strict controls for encryption, access, and audit logging.

We operate within your FCA compliance framework and never hold funds.

Get started

Ready to Recover More?

Turn missed payments into consistent, well-handled conversations — without adding staff or risk.

Start a 30-day pilot and see what consistent recovery conversations can deliver.